Allocate Overhead Cost Formula

When a company is dealing. That is a natural cost of having the same data on 2 places for resiliency.

Traditional Methods Of Allocating Manufacturing Overhead Accountingcoach

Here the labor hours will be base units.

. The costs of those goods which are not yet sold are deferred as costs of inventory until the inventory is sold or written down in value. This article shows how a primary cost element 10001 Electricity flows through the cost objects. You are required to compute a predetermined overhead rate.

Absorption costing is linking all production costs to the cost unit to calculate a full cost per unit of inventories. Many businesses sell goods that they have bought or produced. That means we write two disks at once.

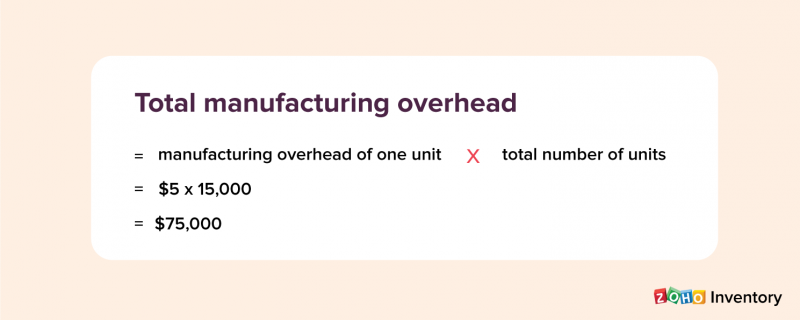

The formula is as follows. In other words the cost objects at the lowest level bear the cost. 1 column 2 disks in a stripe because it is mirroring.

T is a measure used to allocate unallocated overhead costs to products manufactured for better cost planning and monitoring. Direct Materials Cost Formula. The allocated The allocated overhead cost constitutes 60 of the total cost.

122 where C f is the forecast total cost W is the total units of work. Therefore this overhead cost is allocated to the lowest level in the organization. To decide which cost objects to use in your calculations consider using available data to determine any missing.

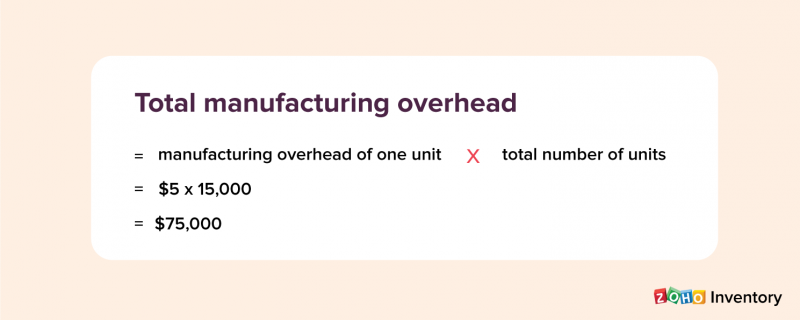

Total overhead total labor hours overhead allocation rate. Cost pool Total activity measure Overhead allocation per unit. FIFO LIFO and Weighted Average.

Cost of goods sold COGS is the. Fiscal period rates are calculated by the overhead calculation. It is sometimes called the full costing method because it includes all costs to get.

How to Calculate Direct Labor Cost per Unit. Thus the overhead allocation formula is. A 9904402 Cost Accounting Standard - Consistency in Allocating Costs Incurred for the Same Purpose provides in 9904402-40 that no final cost objective shall have allocated to it as a direct cost any cost if other costs incurred for the same purpose in like circumstances have been included in any indirect cost pool to be allocated to that or any other final cost objective.

Activity-based costing ABC is an accounting method that identifies the activities that a firm performs and then assigns indirect costs to products. A user-specific rate is user-defined and can be used to allocate cost between cost objects at a predetermined rate in the overhead calculation. Lets look at the following three methods.

You can allocate overhead costs by any reasonable measure as long as it is consistently applied across reporting periods. FIFO First-In First-Out Determining a stocks value using the direct materials cost formula FIFO is a crucial part of accounting. Definition Formula Calculation and.

Cost of goods sold often abbreviated COGS is a managerial calculation that measures the direct costs incurred in producing products that were sold during a period. This costing method treats all production costs as costs of the product regardless of fixed cost or variance cost. Conversion Cost per Unit 610.

Conversion Cost 610000. To allocate costs begin by deciding which cost objects you want to connect with specific costs. Another common example is the use of equipment depreciation schedules to allocate equipment purchase costs.

2TB as blue stripe gives 1TB plus green stripe 1TB too. Heres how that would look if Company A had 700 labor hours per month. Manufacturing Overheads 310000 300000 310000.

The amount incurred as direct labor cost depends on how efficiently the workers produced finished items. This means that for every hour spent consulting Company A needs to allocate 17142 in overhead. Examples include specific products marketing campaigns or business departments and divisions.

For example if the ratio of overhead costs to direct labor hours is 35 per hour the company would allocate 35 of overhead costs per direct labor hour to the production output. The same example can be applied for Mirroring with 1 column. There are two types of rates.

If you require a visual flow of the cost between the cost objects you can use the cost roll-up. The basic formula for forecasting cost from unit costs is. Identify your chosen cost object.

Examples of indirect costs are facility rent utilities and office supplies. An indirect cost is a cost that is not associated with a single activity. When the goods are bought or produced the costs associated with such goods are capitalized as part of.

A Formula for Equipment Cost Recovery The more equipment you use the more accurate equipment cost recovery techniques must be for bidding and reporting purposes. Labor and allocated overhead. Rates are defined per cost object and cost element.

The material cost represents 29 of the total cost while labor costs are 11 of the total cost. Suppose that X limited produces a product X and uses labor hours to assign the manufacturing overhead cost. Activity-Based Costing - ABC.

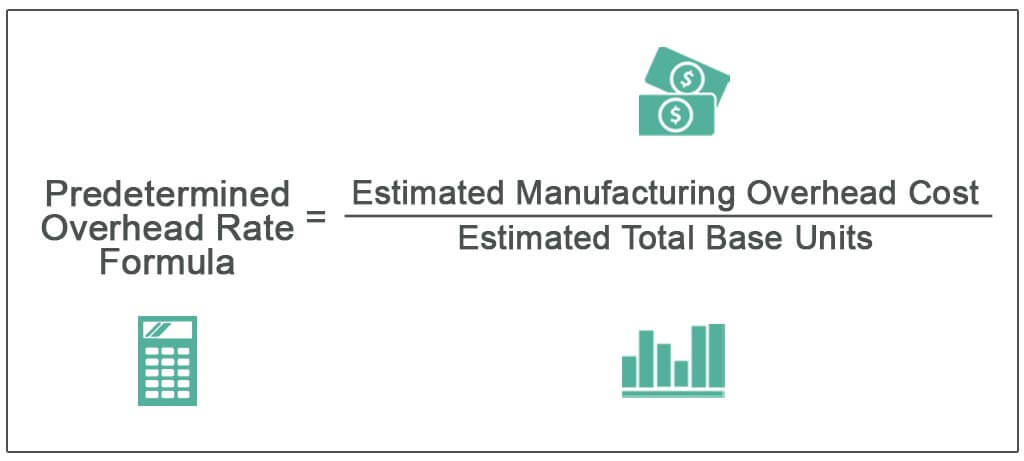

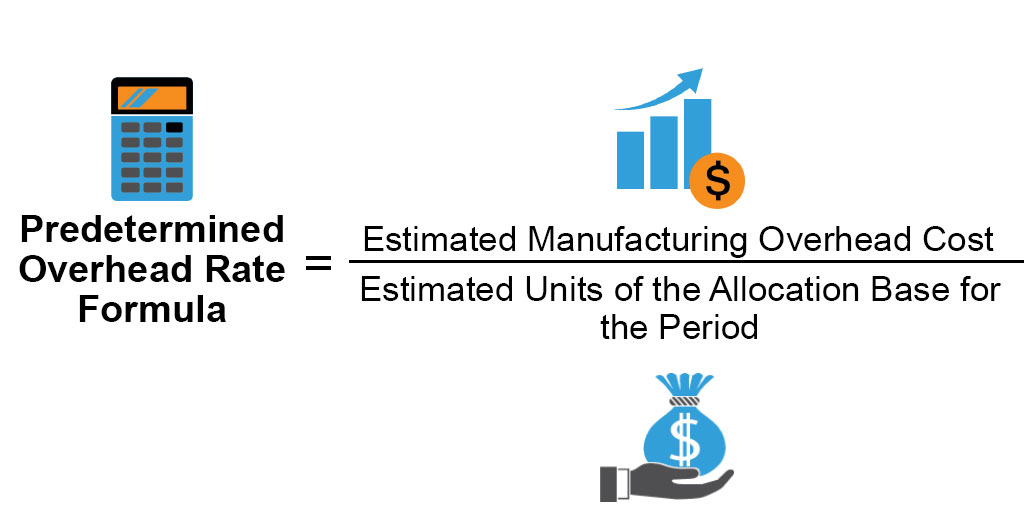

The estimated manufacturing overhead was 155000 and the estimated labor hours involved were 1200 hours. Common bases of allocation are direct labor hours charged against a product or the amount of machine hours used. Fiscal period and user-specified.

Full absorption refers to the assignment of all possible costs to a. Allocations of costs or revenues to particular periods within a project may cause severe changes in particular indicators but have. The picture is the same but capacity is half.

A company may allocate its indirect costs in order to determine the entire cost of a cost object on a full absorption basis. In other words this is the amount of money the company spent on labor materials and overhead to manufacture or purchase products that were sold to customers during the year. Direct material cost per unit is determined to calculate profit on the sale.

Job Costing Full Example Of Overhead Cost Allocation And Overhead Rate Calculation Youtube

Predetermined Overhead Rate Formula How To Calculate

How To Calculate Restaurant Overhead Rate On The Line Toast Pos

Predetermined Overhead Rate Formula Calculator With Excel Template

Indirect Cost Calculation And Process About Ala

Manufacturing Overhead Moh Cost How To Calculate Moh Cost

0 Response to "Allocate Overhead Cost Formula"

Post a Comment